Advance tax is a crucial factor that is often ignored in the Indian tax system. It is the best way to encourage taxpayers to pay in instalments, thereby spreading the financial burden. This method saves individuals and businesses from back-breaking year-end bills and penalties.

In this article, we discuss the essentials of advance tax: its definition, advantages, calculation, deadlines, and practical tips. We will also learn how the best income tax filing software to facilitate the process.

What is Advance Tax?

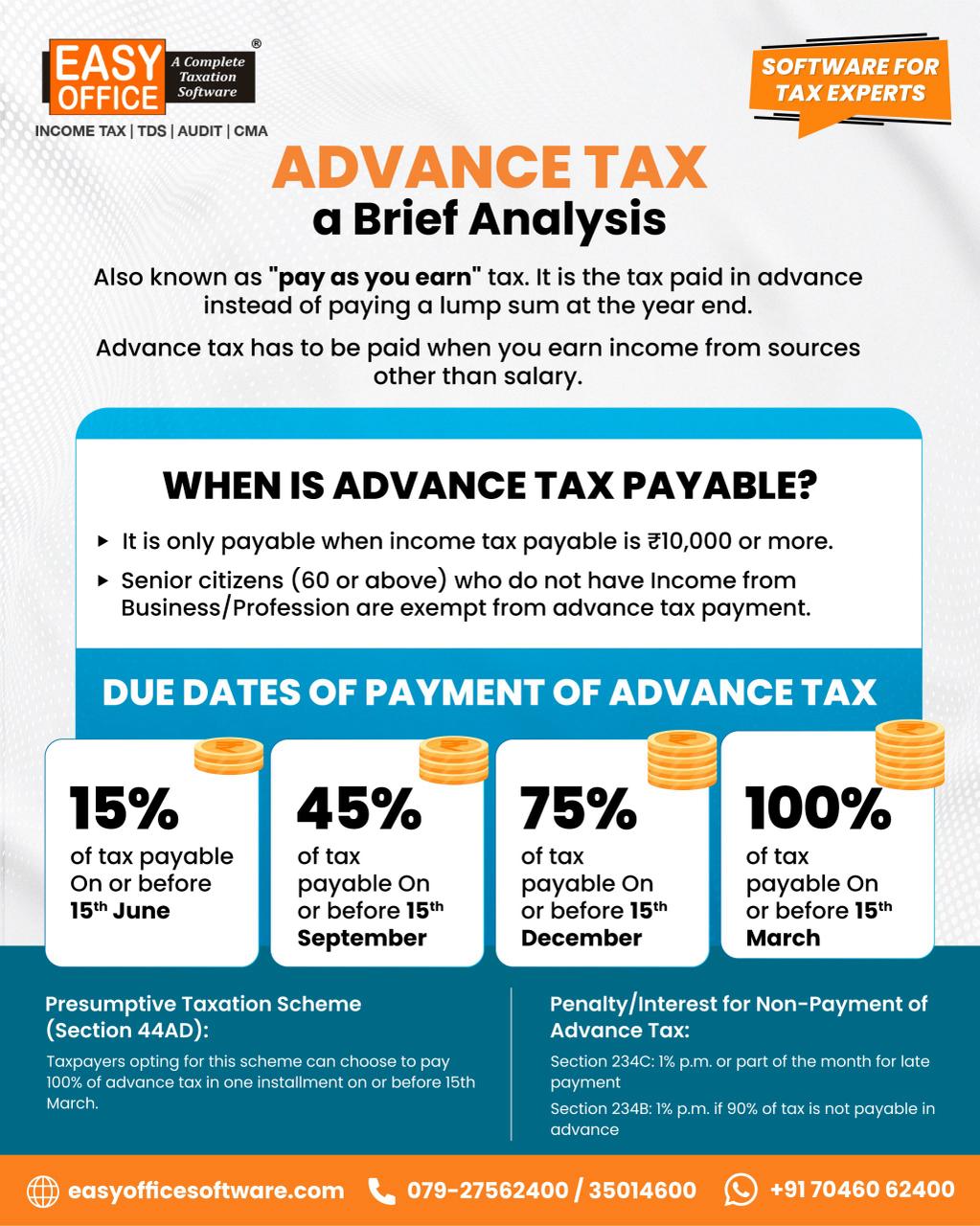

Advance tax, often called "pay-as-you-earn," requires that persons or businesses that calculate their estimated tax liability over ₹10,000 in a particular financial year pay taxes in advance. Such payments are defined by the Income Tax Department to be made in instalments. This regime applies to salaried persons, freelancers, or businesses alike.

Who Should Pay Advance Tax?

The following categories generally fall under advance tax liabilities:

1. Salaried Individuals

When TDS is deducted from salaried income, additional sources such as capital gains, rental income, or freelance work may push your total tax liability beyond ₹10,000

2. Freelancers and Professionals

Income from consultancy or practice without employer-driven tax deduction will attract advance tax in case of tax liability exceeding ₹10,000.

3. Business and Companies

Whether for corporate or non-corporate business, even for sole proprietors, advance tax must be paid. Entities under presumptive schemes (Section 44AD/44ADA) pay the full amount in a single instalment on or before March 15.

4. Senior Citizens

A Resident Senior Citizen without business income is exempted. But, if such an individual earns an income from business or profession, she/he has to pay advance tax.

What is the Advance Tax Payment Schedule for FY 2025-26?

The advance tax for the FY 2025-26 shall be payable in the following instalments.

| Due Date | Advance Tax Payable |

|---|---|

| On or before 15th June 2025 | 15% of total tax liability |

| On or before 15th September 2025 | 45% of the total tax liability minus earlier payments |

| On or before 15th December 2025 | 75% of the total tax liability minus earlier payments |

| On or before 15th March 2026 | 100% of the total tax liability minus earlier payments |

Note: Failure to pay the stipulated amount by these dates may attract interest under Sections 234B and 234C of the Income Tax Act.

How to Calculate Advance Tax?

To compute your advance tax liability:

1. Estimated Total Income: This should include income from salary, business, capital gains, interest, and so on.

2. Eligible Deductions should be deducted under sections such as 80C, 80D, etc.

3. Compute Tax Liability: Apply the existing income tax slabs on net taxable income.

4. Pay TDS: Tax Deducted at Source is deducted.

5. Advance Tax: If the balance payable is more than Rs. 10,000, the provisions for advance tax are applied.

Online calculators provided by the best income tax filing software can make the process easier for correct calculations.

How to Pay Advance Tax Online?

According to the provisions of the Income Tax Department, one can pay advance tax online through the e-filing portal:

Visit the e-filing portal

1. Select 'e-Pay Tax' under 'Quick Links.'

2. Enter PAN and validate the details.

3. Select the appropriate challan from the ITNS 280 form, and enter the required information.

4. Select the mode of payment and complete the payment process.

The receipt for the completed transaction must be preserved.

Consequences of Non-Payment or Underpayment

Failure to pay advance tax or an underpayment could lead to:

• Interest Penalties: Under the Interest Section 234B and 234C for default in payment.

• Reduced Cash Flow: Due to lump-sum tax payments at the year-end.

• Legal Repercussions: For obvious cases of tax evasion.

Keeping up with the timely payment keeps one in compliance and away the unnecessary cash flow problems.

Why Should We Use Software for Tax Compliance?

The best income tax filing software must be employed in general for the digital age:

- Accurate: It calculates the Advance tax due by itself, reducing the possibility of error.

- Time-Saving: Quick to operate, data entry, and processing.

- Compliance: Adheres to the latest Act and provisions.

Such platforms include EasyOffice, which offers user-friendly interfaces and comprehensive features to assist taxpayers.

Final Words

Advance tax is not just a statutory obligation; it is a financial planning tool that helps to spread out the tax liability throughout the year. With good knowledge of its details and the use of technology, a taxpayer complies with the laws, avoids penalties, and maintains healthy management of his or her finances.

Stay connected with us to know more about the Indian Tax System and related details.

FAQ

1. I am a senior citizen with pension and interest income. Should I pay advance tax?

Resident senior citizens not having income from business or profession (not filing ITR 3 and 4) are not liable for advance tax.

2. What happens if I miss the last deadline for payment of the fourth instalment of advance tax i.e. on 15 March?

You can still go ahead with payment of advance tax on or before the 31 March of the year. Payment till 31st March of FY will be treated as advance tax only.

3. Can I pay advance tax after the due date?

One must pay advance tax before the financial year ends in 4 instalments: 15th June, 15th September, 15th December and 15th March. If advance tax is not paid according to the installments, then 1% monthly interest will be levied.

4. What is the minimum amount of tax that is required to be paid as an advance tax by 31st March?

At least 90% of your total tax liability as per the estimated income is required to be paid by the assessee. Failing to which results in interest at the rate of 1% u/s 234B of the Act from the first day of assessment year on the unpaid amount till the date of payment.

5. Is there any compliance if an assessee revises its estimate of income for advance tax?

An assessee can revise the estimation of income and pay the taxes accordingly without any requirement of filing the estimation of income with the department.