Get a EasyOFFICE - IncomeTax Calculation & Return Filling Software

A Special Initiative for Practicing CA's

Truested by 10,000+ CA and Tax Professionals

EasyTax - Example of accuracy, user-friendliness

&

exceptional quality

Key Features of EasyTAX – Income Tax Software

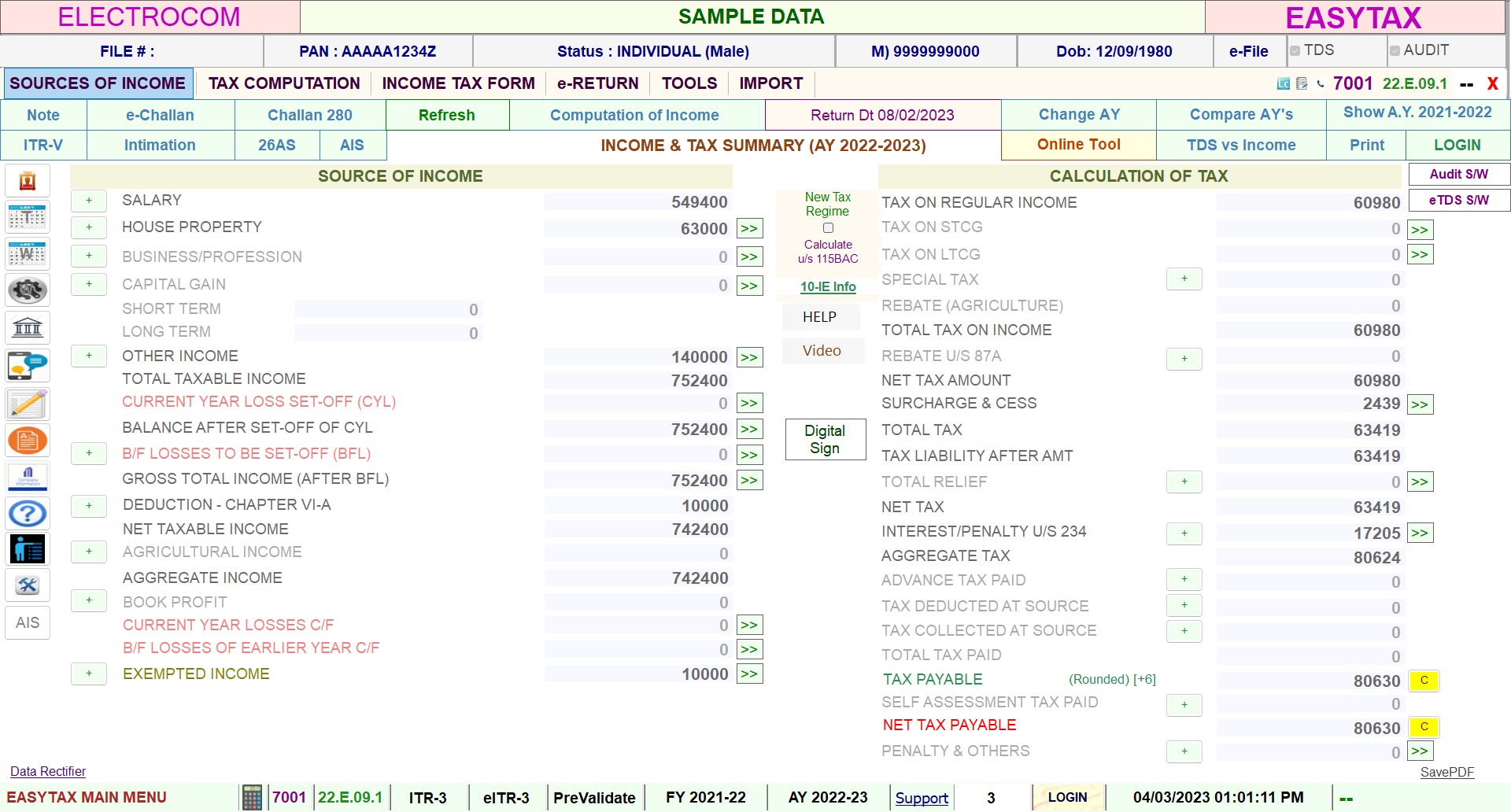

Income Tax Calculation Dashboard

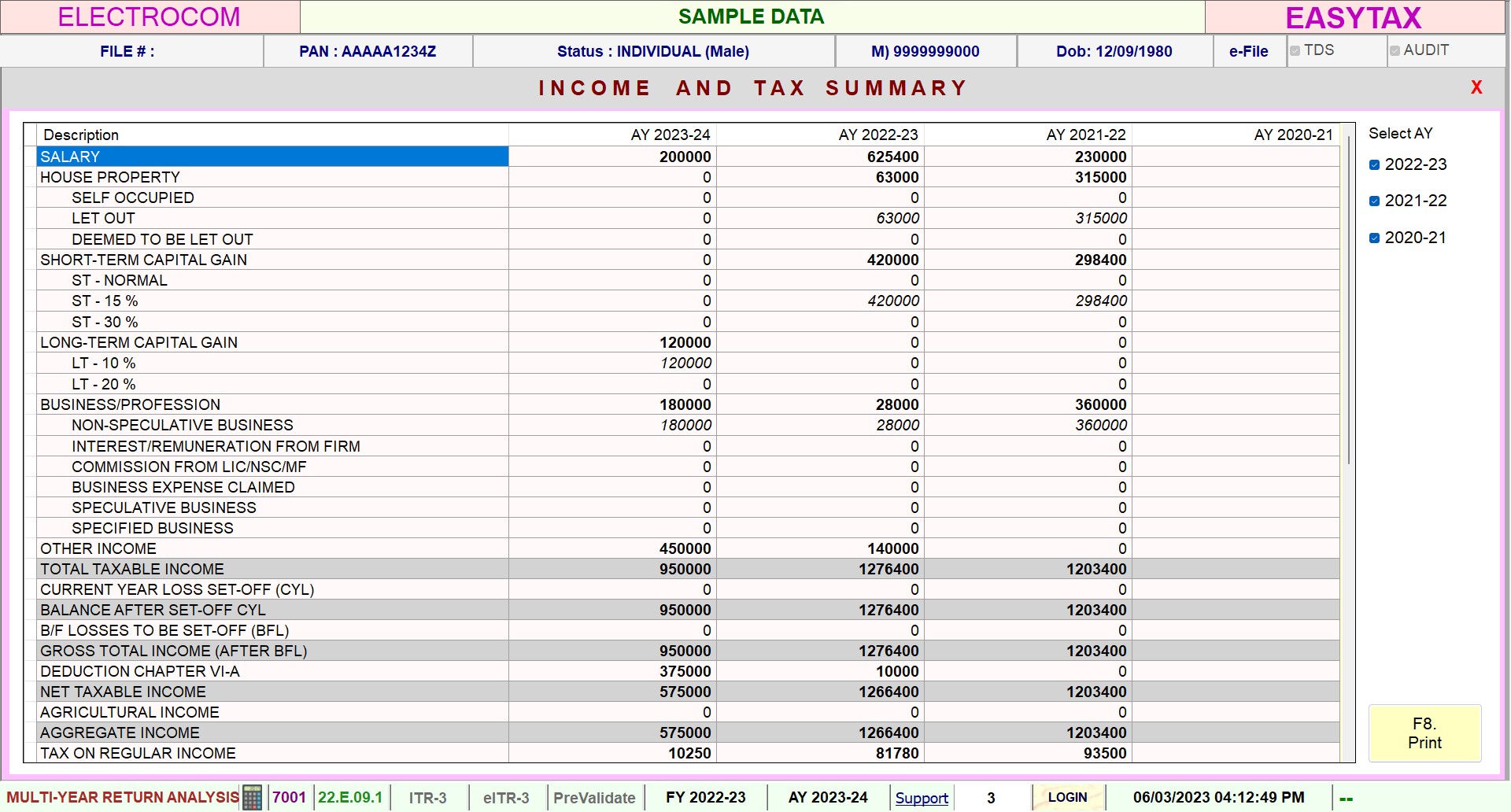

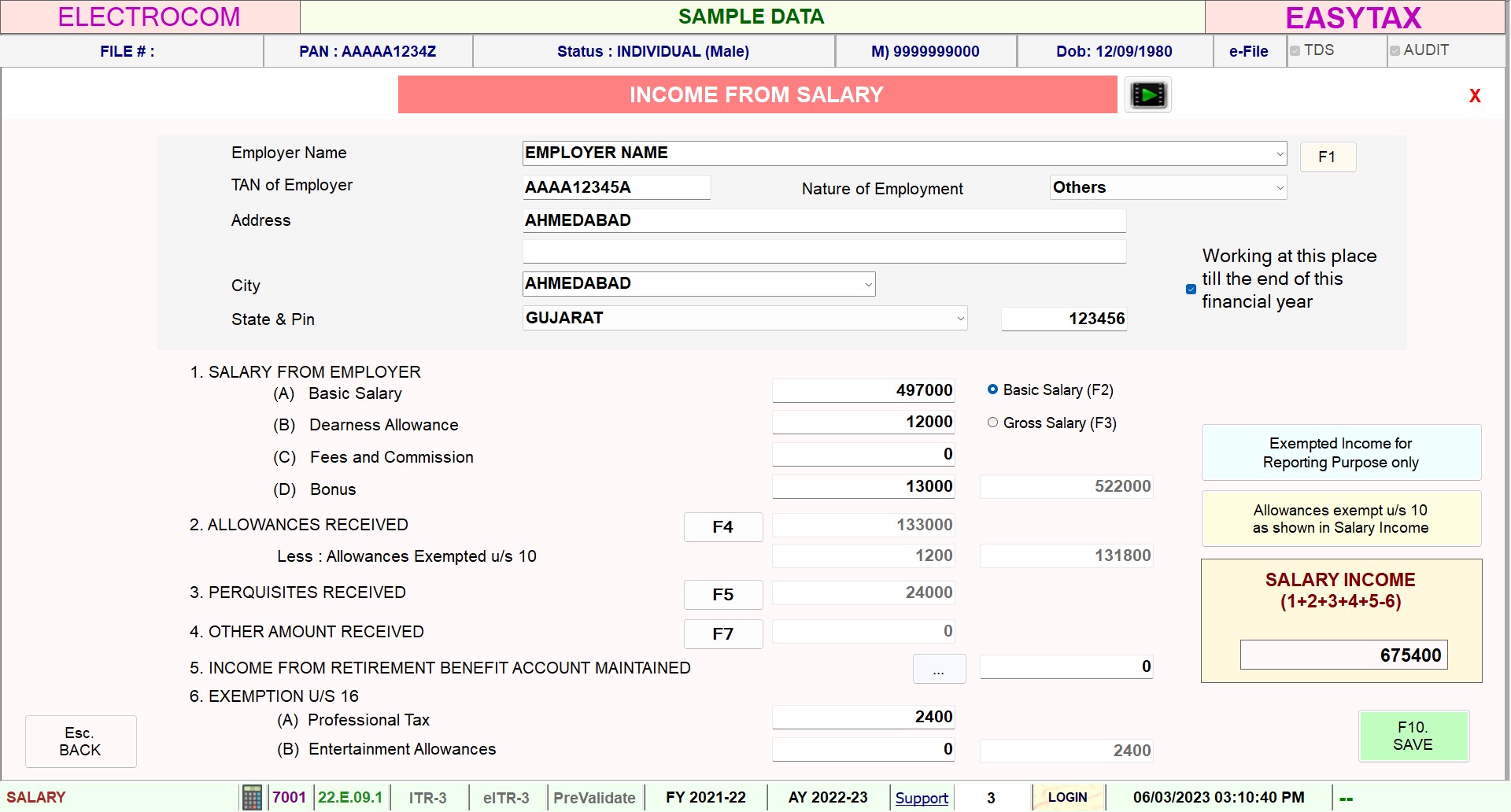

Income Statement / Computation of Income

Auto

generation

of

ITR forms

Import

JSON/

XML file

Direct

ITR Upload

Carry

Forward

Details

Challans

e-Payment

Tax

Register

Auto Losses Adjustment

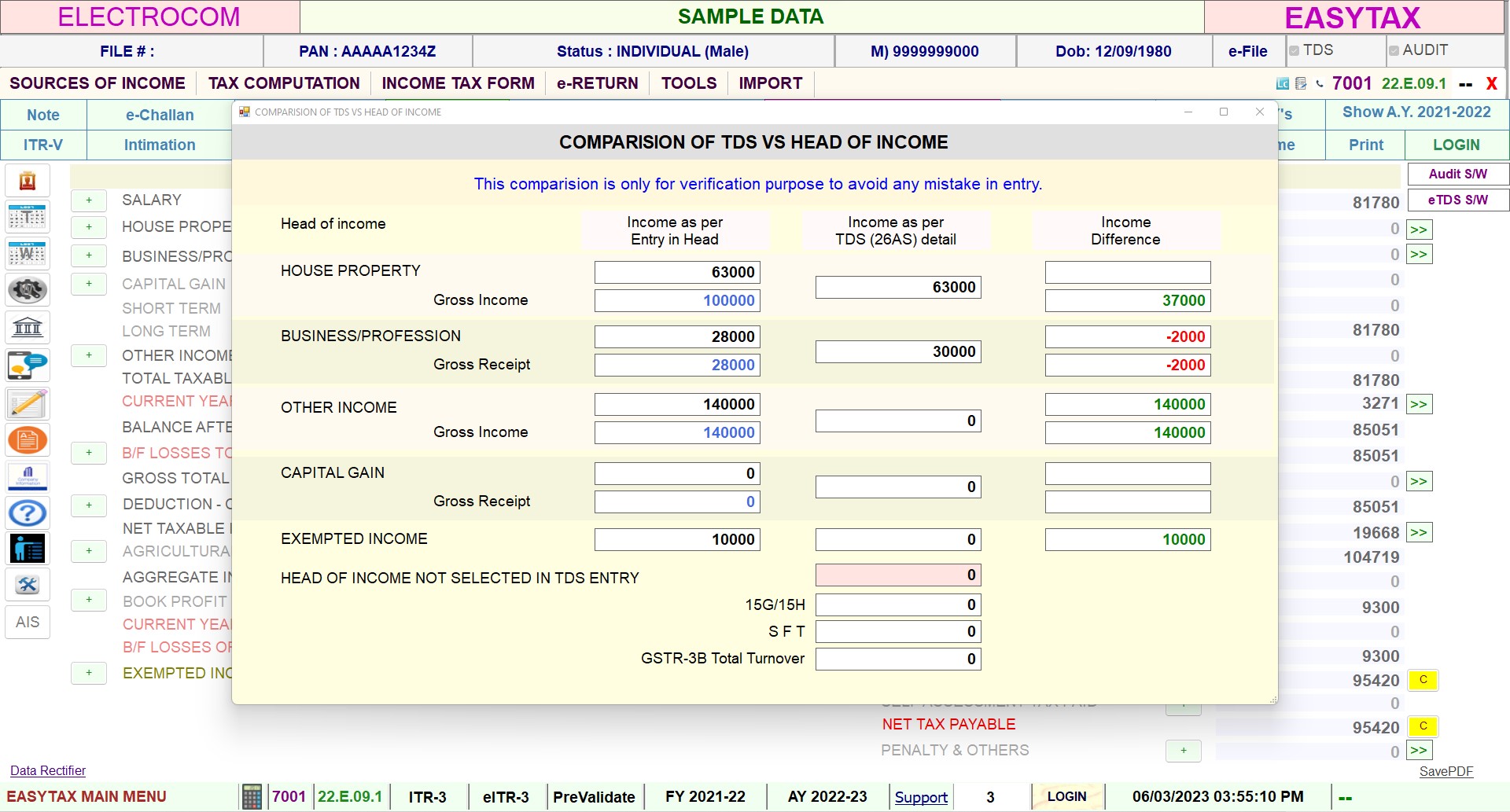

26AS, AIS,

TIS

Direct Import

Interest

Calculation

Advanced

Online

Data

Tool

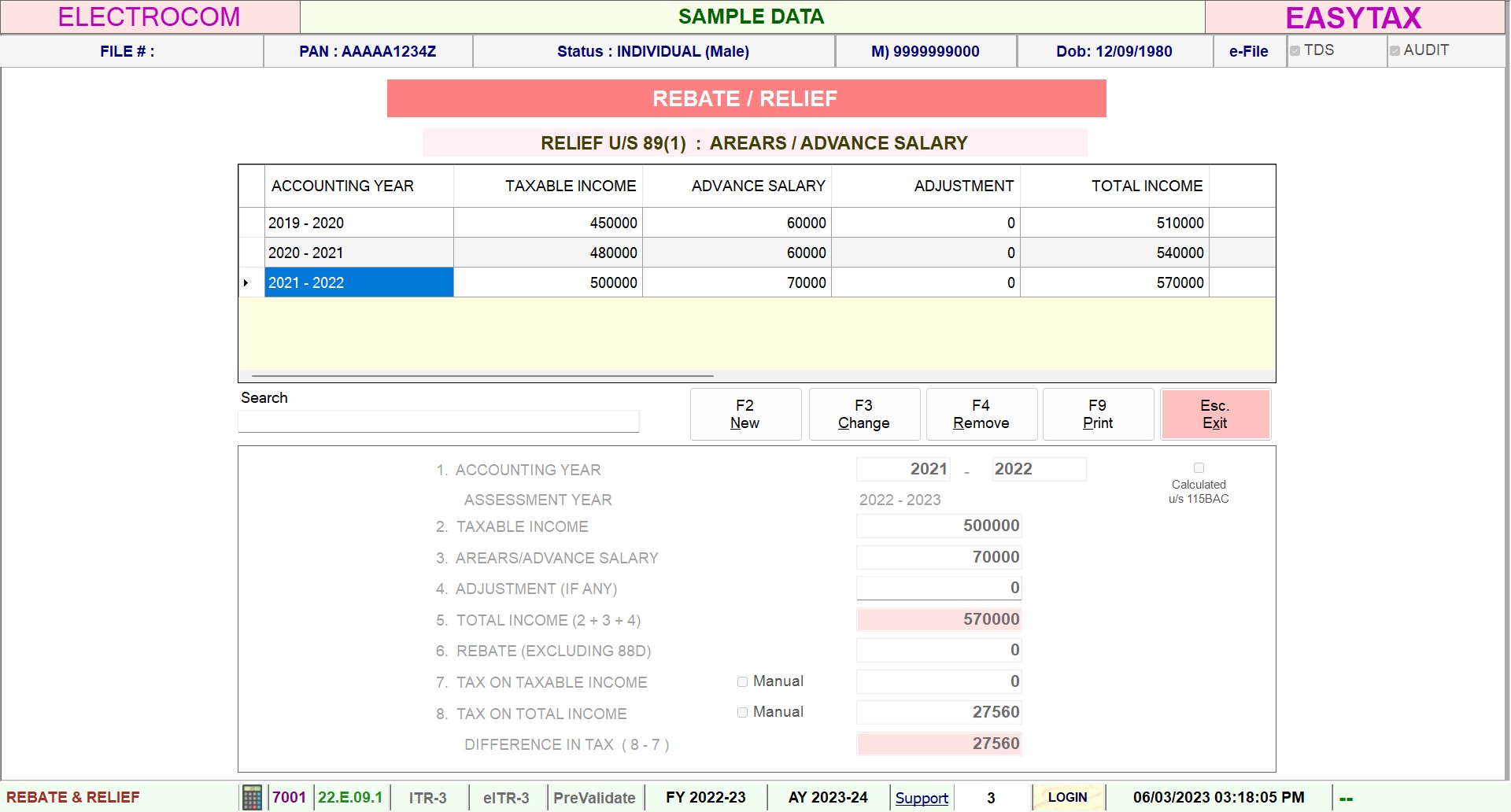

Arrear Relief Calculation

E-mail

Manager

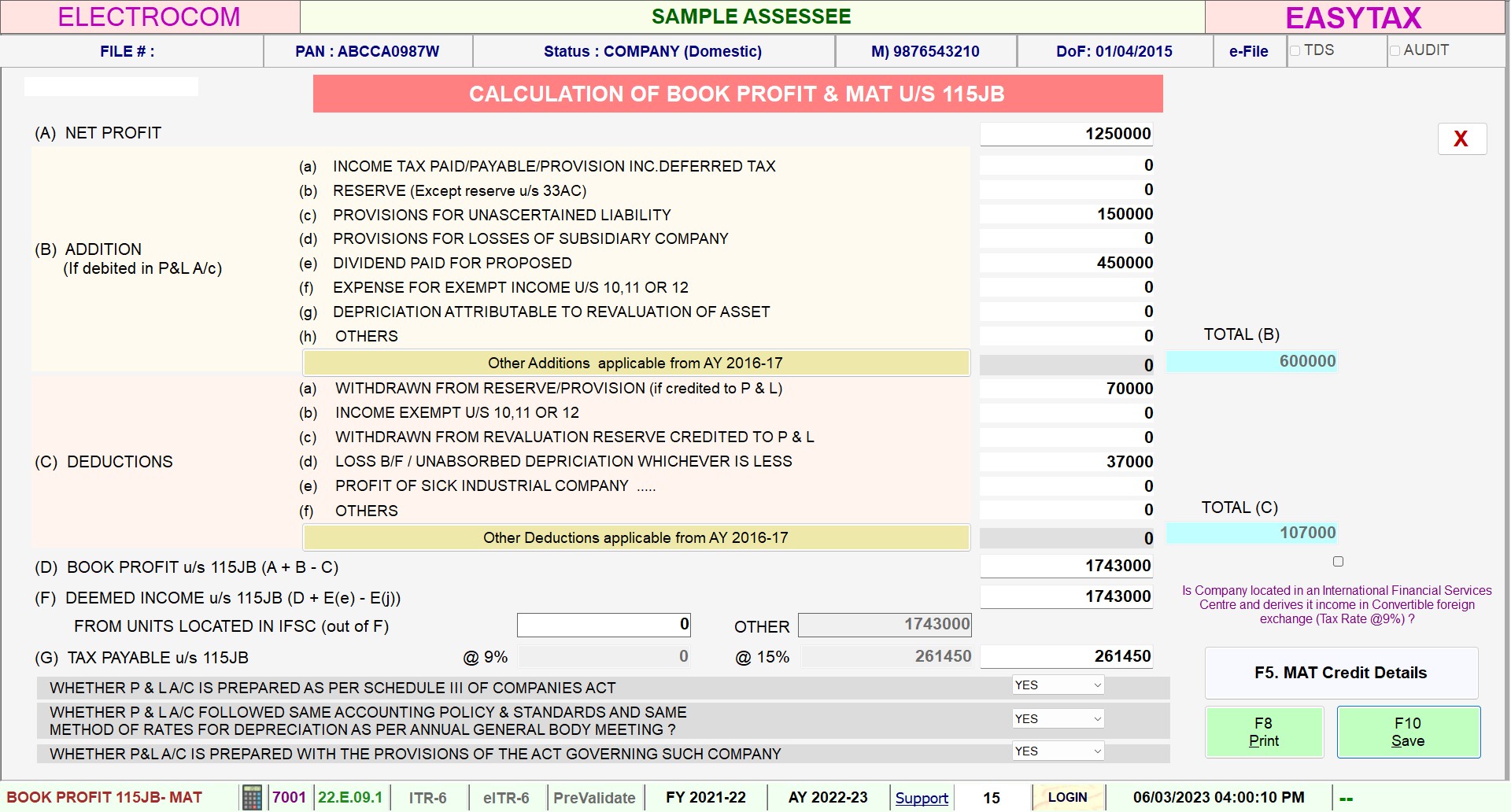

MAT/AMT

Calculation

Multi-Year Income Tax Summary view

Pre-validation

facility

Multi-angle

Analysis Reports

New & Old

Tax

Regime

Updated

Return

Prepare and Upload ERROR-FREE Returns with

the Best Income Tax Software

Join Thousands of CA’s & Tax Professionals

Who believes in EasyOFFICE Software

Try it now

Features at a glance

The hassle-free solution for tax filing

Online Tool Option

- Update Return Status and History

- Update Refund Status

- Collect Assessee profile

- Download and view ITR-V/ ITR Form/ 26AS/ AIS/ TIS / JSON

- Download and view Order and Intimation

Auto Calculation

- NSC Accrued Interest/ HRA/ MATC / Rebate

- Depreciation

- Deduction under chapter VI-A

- Interest u/s 234A, 234B, 234C, 234F

- Index Cost of Acquisition & Improvement

- Grandfathering Rule in Equity Investments

- Salary Arrear Relief u/s 89(1)

- Allowable Remuneration & Interest to Partners in Firm

MultiAngle Analysis Reports

- Return filed / Late filed / Pending

- Assessee Register

- Refund Register

- Tax Register

- Advance Tax / TDS Register

- Order and Intimation

- Assessment Book

- Link Aadhar - PAN

Import Facility

- JSON / XML File

- Balance Sheet / P & L

- Form 26AS/AIS / TIS

- Previous Year data

- Data from Tally

- Data from Default Excel Sheets

E-Services

- Direct e-Return & e-Payment through the software

- E-Return file viewer to view generated JSON file

- Facility to view ITR V & Intimation within the software

- Unique Pre-Validation facility to trace possible errors in e-Return

- Auto save of acknowledgment receipt no

- Direct data fetching for 26AS / AIS / TIS

EasyOFFICE - A highly satisfying tax software

Experience the Convenience … Get the demo today

Office Management Utilities

My Desk

My Invoice

My Documents

Easy Mail

Work Book

Attendance

Notifications/ Circulars

Easy Forms

Why EasyOffice is the first choice for CA & Tax Practitioners?

Easiest Return Filing

Quick upload - Income Tax Return

Competitive Price – starts @ ₹ 2900*

Free Trial

Tech Support

Trusted by Thousands of Tax Professionals

FAQs

EasyOFFICE is considered as the first choice of tax

Professionals because of its user-friendly interface, advanced features, and

comprehensive tax computation capabilities. It simplifies the process of filing

income tax returns and helps tax consultants & CA’s to manage their client’s tax

management efficiently.

When choosing tax filing software several factors

should be considered. The Most important are Accuracy of Tax calculation, Timely

updation, and Price, the software should have a user-friendly interface &

Multi-Angle Analysis Reports. EasyOFFICE's EasyTax is designed to be

user-friendly with accuracy, making it the best Suitable preference for tax

Professionals of all levels.

Yes, EasyOffice Income Tax Module includes features for

importing data from other Taxation software using JSON / XML files. This makes it

easy to transfer Return data from other software into EasyTAX for use in tax

calculations and reporting.

Yes, EasyOffice software offers a free trial version for

interested users. The trial version provides access to the software’s operations for

a limited period, allowing users to test its features and functionalities. The

EasyTAX trial version can be downloaded from our website.

EasyTax offers a wide range of features including

computation of income and tax, tax liability summary, e-filing of returns, deduction

under chapter VIA, self-assessment tax, advance tax, interest calculation under

sections 234A, 234B, 234C, 234F & more features. It also offers easy import/export

of data, user-friendly interfaces and advanced online tools, making it a preferred

choice for tax professionals and consultants.

There are various Tax Software available in the Market.

Easyoffice Income Tax Software is one of the Preferred & Trusted choice of Chartered

Accountants & Tax Professionals for ITR efiling.