Special Offer For Practicing Chartered Accountant

Special Offer For Practicing Chartered Accountant

The Union Budget 2025-26 has great reforms for the economy, using which it targets growth, increased social welfare, and improved self-reliance in India.

As presented by Finance Minister Nirmala Sitharaman, this budget covers changing tax policies, infrastructure growth, health, agriculture, and technology development.

Here’s a breakdown of the key points and the related impact on various sectors.

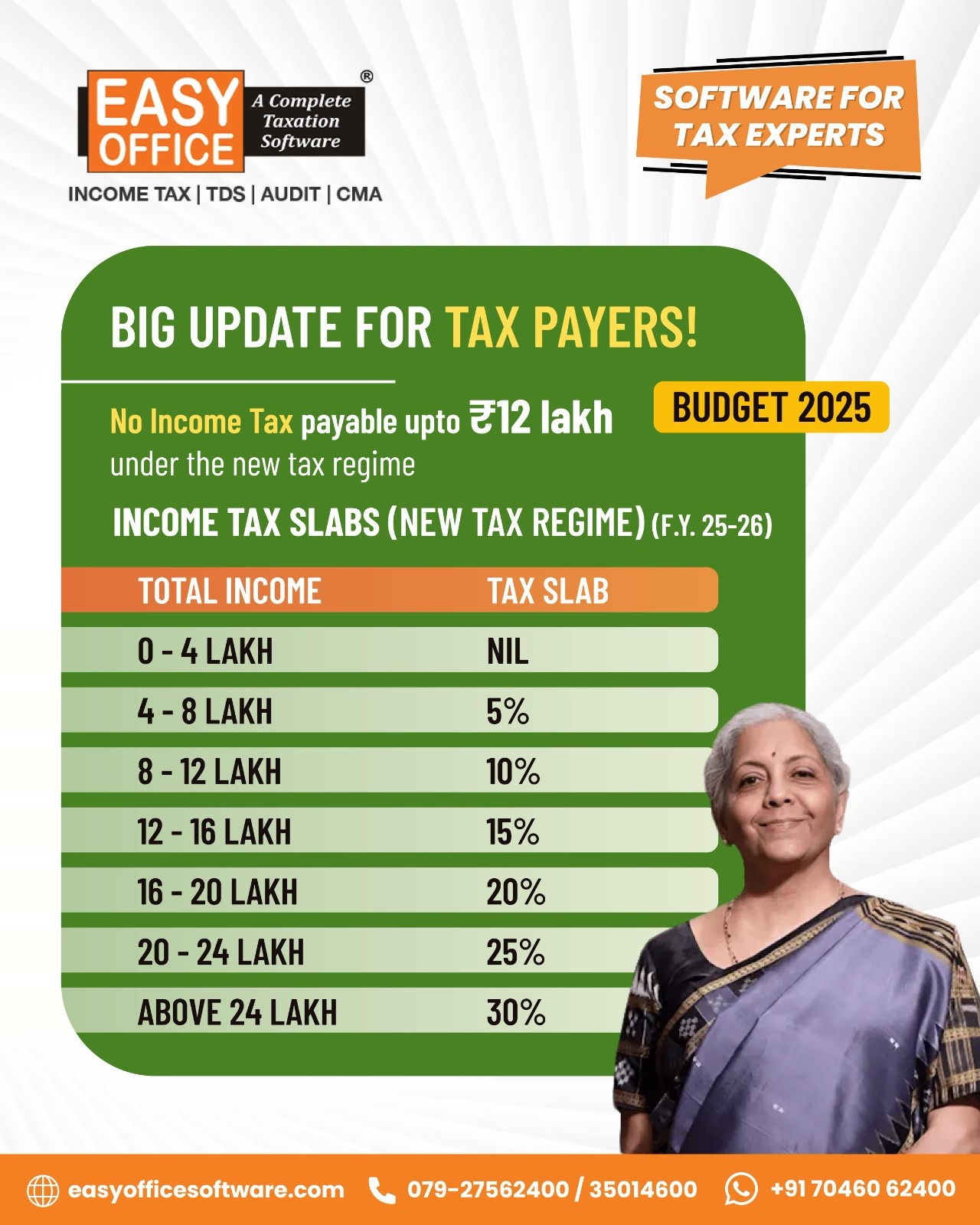

Taxation policy updates are one of the highly anticipated topics in the budget. The new tax regime has been made simple regarding compliance and benefits to taxpayers. Those earning up to ₹ 12 lakh annually are proposed to have zero tax liability under the revised tax structure. The differences between the old regime and the new regime are illustrated below:

| Old Regime Slab | Old Regime Rate | New Regime Slab(Proposed) | New Regime Rate (Proposed) |

| Up to ₹ 2,50,000 | Nil | Upto ₹ 4,00,000 | Nil |

| ₹ 2,50,001 - ₹ 5,00,000 | 5% | ₹ 4,00,001 - ₹ 8,00,000 | 5% |

| ₹ 5,00,001 - ₹ 10,00,000 | 20% | ₹ 8,00,001 - ₹ 12,00,000 | 10% |

| Above ₹ 10,00,000 | 30% | ₹ 12,00,001 - ₹ 16,00,000 | 15% |

| ₹ 16,00,001 - ₹ 20,00,000 | 20% | ||

| ₹ 20,00,001 - ₹ 24,00,000 | 25% | ||

| Above ₹ 24,00,000 | 30% |

The New Regime tax slabs for A.Y. 2025-26 are as follows.

| Total Income | Rate of Income Tax |

| Up to ₹ 3,00,000 | Nil |

| ₹ 3,00,001 - ₹ 7,00,000 | 5% |

| ₹ 7,00,001 - ₹ 10,00,000 | 10% |

| ₹ 10,00,001 - ₹ 12,00,000 | 15% |

| ₹ 12,00,001 - ₹ 15,00,000 | 20% |

| Above ₹ 15,00,000 | 30% |

(1) TDS Limit on rental income increased to ₹ 6 lakhs annually from ₹ 2.4 lakh

(2) For senior citizens, tax deduction limits were increased to ₹ 1 lakh from ₹ 50,000, providing additional relief.

To assist taxpayers in managing their finances efficiently, using the best taxation software can simplify compliance and ensure accurate tax calculations.

The government has made an outlay of ₹ 10.18 lakh crore for capital expenditure to further economic growth. Other major announcements include:

- Interest-free loans of ₹ 1.5 lakh crore to the states for infrastructure projects.

- Over 100 new regional airports are planned to be built over the next ten years.

- Extension of UDAN 2.0 to link 120 new airports, especially in Northeast India and Bihar.

The government brought about measures to support the rapid growth of the gig economy in the country by introducing benefits for people working at platforms like Swiggy, Zomato, and Zepto.

The benefit of ID cards will be granted to one crore gig workers to access social security benefits and join the PM Jan Arogya Yojana.

To promote Entrepreneurship and Innovation, this budget will benefit the startup a five-year startup tax benefit from the date of incorporation.

Revision of MSME classification and MSME’s credit guarantees are proposed to be expanded by increasing provision from ₹ 5 cr. to ₹ 10 cr.

In the proposed budget, healthcare appears to be given priority. The following are included in it:

- 200 new daycare cancer centers across districts by the year 2026

- Six new life-saving drugs will be taxed at 5%

- 36 other critical medicines will be exempted from Basic Customs Duty (BCD)

- Patient assistance programs of pharmaceutical companies will also be exempted from BCD, provided medicines are given free of charge.

These are the several big initiatives proposed by the budget towards education:

- Atal Tinkering Labs to be established in schools.

- Broadband internet for all government secondary schools.

- Expansion of IIT Patna infrastructure among students.

The agriculture budget is inclusive of the following:

- A six-year mission on self-reliance in oilseed production,

- A five-year initiative for improving cotton yield,

- Increase in Kisan Credit Card loan limit from ₹ 3 lakh to ₹ 5 lakh,

- ₹ 15,000 crore is allocated to complete one lakh housing units in rural areas.

These are some special schemes for women's empowerment as first-timers:

- Term loans of up to ₹ 2 cr. will be given to women from SC/ST and backward classes starting in entrepreneurship.

- Nutritional support schemes will help more than eight crore children and one crore lactating mothers.

The government has also announced special schemes to upgrade the technological and digital landscape of India:

- Establishment of a Centre of Excellence in Artificial Intelligence (AI) with an outlay of ₹500 crore.

- More capital goods are exempted for EV battery manufacturing.

By recognizing the importance of water conservation, the Jal Jeevan Mission has been extended till 2028, which will ensure the provision of safe drinking water to households in rural areas.

The Union Budget 2025-26 will present a simple, easy tax framework without complexity, saving money and reducing compliance burdens for businesses and individuals. Maximizing the efficiency of the best taxation software can streamline tax filings, extract valuable deductions, and keep current with regulatory changes.

Union Budget 2025-26 makes a strong foundation for the economic resilience and social advancement of the country because it incorporates taxation reforms, expansion of infrastructure, improvements in healthcare, and technological advancements. This budget is a stepping stone towards creating a self-reliant and globally competitive India with ease in doing business, digital transformation, and inclusive growth.

For businesses and individuals seeking seamless tax management, EasyOffice Software is the best taxation software to navigate compliance efficiently. Stay informed and make the most of the opportunities presented in this year's budget.

No related blogs found!